Why Cybersecurity Insurance is Key to Protecting Your Business from Digital Threats

Why Cybersecurity Insurance is Key to Protecting Your Business from Digital Threats

Understanding Cybersecurity Risks

The landscape of cybersecurity threats is diverse and constantly evolving. Here are some of the most prevalent threats.

- Ransomware: This type of malware encrypts a victim’s files, rendering them inaccessible until a ransom is paid. Ransomware attacks surged in recent years, with high-profile cases affecting major corporations and municipalities.

- Data Breaches: Unauthorised access to sensitive information can lead to identity theft, financial fraud, and loss of customer trust. Data breaches often result from weak security protocols or employee negligence.

- Phishing Attacks: These deceptive tactics involve tricking individuals into providing sensitive information by impersonating legitimate entities. Phishing remains one of the most common entry points for cybercriminals.

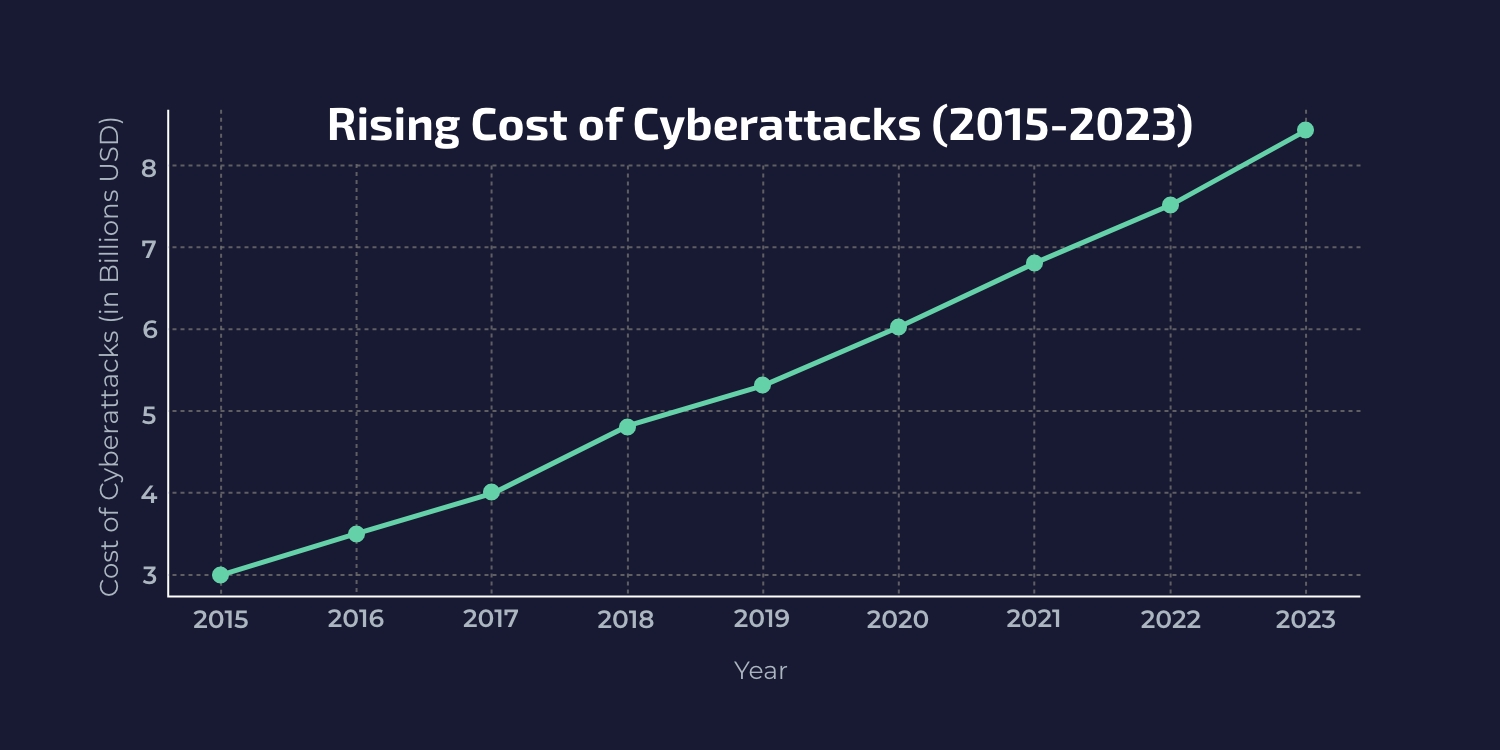

The financial and reputational impacts of these threats can be catastrophic. Businesses may face direct costs related to recovery efforts, legal fees, and regulatory fines, as well as indirect costs from lost customer trust and market share. A report by Cybersecurity Ventures predicts that global ransomware damages will exceed $265 billion by 2031, underlining the urgency for organisations to strengthen their defences.

The Benefits of Cybersecurity Insurance

Financial Protection

Cyber insurance softens financial losses incurred from cyber incidents. Policies typically cover expenses like data recovery, legal fees, notification costs, and business interruption losses. This financial support is essential for maintaining operational continuity after an attack.

Comprehensive Coverage Options

- First-Party Coverage: This includes costs directly incurred by the business due to a cyber incident, such as data restoration and forensic investigations.

- Third-Party Liability Coverage: This protects against claims made by clients or partners resulting from data breaches or other cyber incidents. It can cover legal expenses and settlements.

- Support for Compliance: Many industries face strict regulatory requirements regarding data protection. Cyber insurance can help businesses meet these obligations by covering compliance-related costs and providing legal support during investigations.

- Encouragement of Best Practices: Insurers often require policyholders to implement specific cybersecurity measures before coverage is granted. This encourages organisations to strengthen their security posture proactively. For example, TIAL emphasises the importance of adopting robust cybersecurity measures as part of their commitment to client relationships and risk management strategies.

Choosing the Right Cybersecurity Insurance Policy

Selecting an appropriate cybersecurity insurance policy involves careful consideration of several factors.

- Coverage Limits and Exclusions: Businesses should evaluate their specific needs and make sure that the policy covers potential risks adequately. Understanding exclusions is equally important to avoid unexpected gaps in coverage.

- Risk Assessment: Conducting a thorough risk assessment helps organisations identify vulnerabilities and determine the level of coverage required. This process is critical for tailoring policies to fit unique business needs.

- Working with Experienced Brokers: Collaborating with brokers who specialise in cybersecurity insurance can provide valuable insights into available options and help businesses navigate complex policy terms. Experienced brokers can assist in identifying tailored solutions that align with an organisation’s risk profile.

Best Practices for Cyber Risk Management

- Implement Strong Cybersecurity Measures: Organisations should invest in firewalls, intrusion detection systems, and regular software updates to safeguard their networks against attacks. Implementing multi-factor authentication (MFA) adds an extra layer of security against unauthorised access.

- Employee Training: Regular training sessions on cybersecurity awareness can empower employees to recognise and respond effectively to potential threats. TIAL highlights the importance of continuous education in enhancing overall security.

- Regular Policy Reviews: Businesses should routinely assess their cybersecurity policies and coverage to remain aligned with evolving threats and regulatory requirements. Regular reviews help identify any gaps in coverage or outdated practices that need updating.

- Incident Response Planning: Having a well-defined incident response plan minimises damage during a cyber incident. This plan should outline roles and responsibilities, communication strategies, and recovery procedures. Regular drills can ensure that employees are familiar with the protocol.

The Role of Technology in Cybersecurity Insurance

As cyber threats evolve, so must the tools used to combat them. Advanced technologies such as artificial intelligence (AI) and machine learning (ML) are integral in assessing risks and detecting anomalies within networks.

- Leveraging Data Analytics: Insurance providers are increasingly using data analytics to enhance decision-making processes related to underwriting and claims management. By analysing vast amounts of data, insurers can better understand risk profiles and tailor policies accordingly.

- Automation in Claims Processing: With the demand for speed and accuracy, automation allows insurers to handle claims swiftly while minimising errors. Embracing automation can revolutionise claims operations and set new standards for excellence in the insurance sector.

As highlighted throughout this article, understanding the complexities of cybersecurity insurance, and its proactive measures, will empower businesses to navigate today’s digital landscape. By understanding their risks and leveraging the benefits of insurance alongside advanced technologies like those offered by TIAL, organisations can position themselves more securely in an uncertain digital future.